Cardano Price Analysis: Is ADA Ready to Break Out Despite SEC ETF Filing Setbacks?

As we enter the last quarter of 2025,Cardano (ADA) is at a very important point in the cryptocurrency market. ADA has been strong, bouncing back from critical support levels, even if the market is worried about regulations. It is trading around $0.80. The U.S. Securities and Exchange Commission (SEC) has asked for the withdrawal of 19b-4 filings for several altcoin ETFs, including those for Cardano, Litecoin, XRP, Solana, and Dogecoin.

The proposal has raised concerns aboutdelaysin institutional adoption. Even while these changes seem like they will slow things down, analysts say that this change in procedure could speed up approvals under the new generic listing rules. This could make it possible for spot ADA ETFs to be available by the end of October.

Bitcoin is holding steady above $110,000, and Ethereum is looking around $4,300. The altcoin market is ready for a risk-on bounce. The issue still stands for Cardano, a cryptocurrency known for its intellectual rigor and scaling enhancements like the recent Chang hard fork: Can ADA break out of its multi-month consolidation and reach $1.30 or higher?

This research looks at technical indications, fundamental factors, and price expectations to see if there is a chance of a breakout, even though there are still questions about ETFs.

A Look at the Current Market: Ada’s Steady Hold While Other Coins Drop

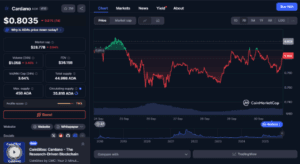

Cardano’s price movement in late September 2025 is similar to the cautious optimism that is spreading through the crypto markets. ADA dropped to $0.7866 earlier this week, testing a key support level around $0.80. It then bounced back somewhat to $0.815, a 0.9% daily gain as of September 30. This bounce back happened at the same time that Bitcoin’s dominance dropped slightly, which has been about 52%, letting altcoins like ADA catch a bid.

Source: CoinMarketCap

ADA has lost roughly 3% in the last seven days, which is worse than the market as a whole, which has lost 1%. But trade volume has gone up 15%, which means that both regular and institutional investors are interested again. On-chain measurements show a mix of good and bad signs: Active addresses rose 12% from one week to the next, and over 70% of the circulating supply is still staking, which is a strong sign.

This liquidity buffer could help protect against more losses, especially if global economic forces, like the expected Federal Reserve rate reduction, make riskier assets more valuable. The ETF story makes things more intriguing. The SEC’s request for filing withdrawals isn’t a full rejection; it’s a way to make things easier under new Nasdaq rules that went into effect in September.

Grayscale’s spot ETF application for ADA is now waiting for a decision on its S-1 registration by October 26. Prediction markets give it a 91% chance of getting approved. Eric Balchunas, an analyst at Bloomberg ETF, agrees with such predictions and says that the chances of an altcoin ETF happening after the reforms are 100%, putting Cardano ahead of other coins like Dogecoin.

In short, ADA is currently in a defensive but ready position. Should the price maintain its stability above $0.80 for an extended period, it may begin to accelerate in the near future. If it goes below that, it could test $0.73 again, which was the psychological floor of the lows in August.

Technical Analysis: What the Signals Mean, Pointing to a Breakout That Will Happen Soon

When you look at the charts, Cardano’s technical setup screams “bear trap” potential. ADA is coiling inside a falling wedge pattern on the daily timescale. This is a typical bullish reversal pattern that has kept prices below $0.95 since they peaked in July. The upper trendline of the wedge lines up with the $0.85 resistance level, and the lower boundary hugs the $0.75 support level. This scenario makes for a tighter range that is ready to explode.

This narrative is supported by significant indicators. The Relative Strength Index (RSI) on the 4-hour chart is at 48, which is just above the oversold level of 30. This means that bearish momentum is slowing down but not completely giving up.

This neutral position, along with a bullish divergence—where price lows get lower but RSI highs stay the same—suggests that buyers are quietly building up. The Moving Average Convergence Divergence (MACD) histogram is also flattening at the zero line, and the signal line crossing is about to happen. If the crossover happens, ADA might go up to $0.90 in just a few days.

Exponential moving averages (EMAs) make things more certain. The 50-day EMA ($0.82) has started to curve higher and cross the 200-day EMA ($0.78) in a new golden cross. This crossover is a medium-term buy signal that hasn’t been seen since Q2 2025.

Volume-weighted average price (VWAP) bands show that breakouts are more likely to happen: ADA is close to the lower band at $0.79, and the rising on-balance volume (OBV) suggests that there is hidden buying demand.

When you look at the weekly chart, seasonal tendencies favor bulls. Historical data shows that ADA has gained an average of 45% in the fourth quarter. This gain is because of year-end portfolio rebalancing and holiday liquidity spikes. If this prediction is true, a clean wedge breakout could aim for the measured move extension at $1.32, which is the 1.618 Fibonacci level from the July high.

There are still risks, though. If ADA doesn’t get back to $0.85, it might confirm the bearish head-and-shoulders invalidation and push it down to $0.66.

But when the Ichimoku Cloud turns green (the price goes above the cloud base), the route of least resistance goes up. Traders should keep an eye on the $0.80 pivot. If it closes above it every day, shorts are no longer valid, and traders should look for $1.00.

The ETF Hurdle: Problems or a Change in Strategy?

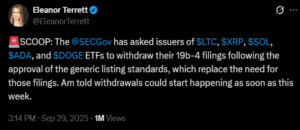

You can’t talk about ADA’s path without also talking about what the SEC is doing with ETFs. The agency’s September 29 order to pull 19b-4 paperwork for cryptocurrency goods, including Cardano’s, initially made investors nervous because it reminded them of the protracted delays in 2025.

For Grayscale’sADA ETF, the withdrawal meant putting the phase of changing the exchange rules on hold, which pushed back the deadline and fueled stories of regulatory interference.

Source: X

However, there is a positive aspect to the situation. The withdrawals are because the SEC adopted “generic listing standards” on September 17. For assets that meet these standards, the lengthy 240-day 19b-4 examination is eliminated.

This system now solely relies on S-1 registrations for approvals, a process that takes 75 days. Balchunas says the change makes things fairer, with Solana and XRP ETFs at the front of the line. However, Cardano’s solid compliance record (it doesn’t have any outstanding SEC cases like XRP does) gives it an advantage.

The effects on the market are huge. Since their inception in 2024, spot Bitcoin and Ethereum ETFs have brought in $50 billion in new money.VanEckthinks an ADA equivalent might bring in $5–10 billion in the first year, which would increase liquidity and price discovery. This optimism is shown in prediction markets: There is a 90% chance that the ADA ETF will get the go-ahead by the end of the year, up from 65% before the changes.

Critics argue that Cardano lacks the DeFi excitement of Solana and the business ties of XRP, making it a “vanilla” alternative. This could mean that hype-driven pumps will take longer to happen. But for those who want to hold on to their ADA for a long time, this clear regulatory environment is more important than short-term noise.

Basic Catalysts: Cardano’s Ecosystem Thrives Beyond Price

Cardano’s breakout depends on fundamentals, not just technicals and ETFs. The Voltaire era, which will go live in full with the Chang update in Q3 2025, brings on-chain governance, giving ADA holders the chance to vote on how the treasury is spent.

This has led to more dApps being made: data from mid-September shows that there are over 1,200 active projects, a 40% increase from last year, andDeFi TVL has passed $2 billion, which is close to Solana’s highs in early 2024.

Interoperability is also excellent. Partnerships withPolygonfor zk-rollups and connections with Chainlink oracles make it possible to scale up to 1,000 TPS without sacrificing security. Real-world application is gaining ground: Ethiopia’s school credentialing experiment currently has 5 million participants, and African remittances using ADA settle 20% faster than older systems.

Bearish arguments against it include the Dencun upgrade on Ethereum and the meme-fueled rallies on Solana. But Cardano’s proof-of-stake system, which uses only 0.0001 kWh per transaction, is popular with ESG-focused institutions, which gives it an edge in a world that cares about carbon. These layers show that ADA’s value offer goes beyond speculation, creating organic demand that might boost any ETF tailwind.

Price Prediction: Bullish Targets and Risk Scenarios

Putting all of this together, ADA’s prediction for 2025 is too positive. In the short term (Q4 2025), a breakout over $0.85 could lead to a target of $1.00 (conservative) to $1.34 (Fibonacci extension) if the ETF situation is clear by October 26.

For the next few years (until the end of 2025), analysts expect the average price to be $1.10, with highs of $1.88 if Bitcoin goes above $120,000. Stretch goals go up to $2.05 when the ETF gets all its money and the ecosystem hits certain goals.

Risks on the downside: If the SEC continues to delay, the price could go up to $0.66. If there is a macro recession, it could go down to $0.50. There is a 65% possibility that the price will be $1 or more by December.

Final Thoughts: Breakout Calls for the Patient

Even if there have been problems withSEC ETF filings, Cardano’s technical strength, regulatory support, and strong fundamentals make ADA a good candidate for a big surge. As bears get tired and institutions move in, $1 is the next big number to watch. This isn’t naive hope for investors; it’s a strong belief in a product that will last. Place your bets and watch the wedge snap.